AML/CTF Tranche 2 Reforms

What is Tranche 2 of the AML/CTF reform?

The AML/CTF Act 2006 historically targets the financial sector and other businesses that involve large transfers of cash – the gambling sector, remittance or money-transfer services, bullion dealers and more. A list of designated services – including taking deposits, payroll services and currency exchange – is included in the Act, and any business that provides one or more of these services must comply with the regulations. Some financial institutions are also required to report transactions over a certain threshold, along with any suspicious activity.

On 29 November 2024, the AML/CTF Amendment Bill (Tranche 2) has passed the House of Representatives and will be enacted. This means that those who operate in the real estate, law, and accounting sectors need to start looking at how this will affect them too, and get their processes in place, ready to go.

On 29 August 2025, AUSTRAC tabled the new AML/CTF Rules 2025 in Parliament, following a two-stage public consultation. The Rules, published on the Federal Register of Legislation with an Explanatory Statement, set out how they work with the amended AML/CTF Act 2006 and what reporting entities must do to be compliant.

Adhering to the rules isn’t just a legal requirement, it’s also an important way to prevent criminal activity – and protect your business reputation.

Understanding AML/CTF Rules 2025

The AML/CTF Rules 2025 runs to 120+ pages of legalese, obligations, definitions and reporting detail. First AML's compliance team have done the heavy lifting: translated it into plain English, added real-world examples and highlighted what matters for Tranche 2 entities.

AML/CTF Rules 2025: A plain-English overview for busy professionals

Making sense of Australia's AML/CTF Rules for Tranche 2 entities.

Layman's guide to Part 2: Reporting groups

Understand business groups, elected reporting groups, lead entity requirements and compliance obligations

Layman's guide to Part 3: Enrolment

Understand what service, business, group, and financial details you need to provide and how to keep your information up to date.

Layman's guide to Part 5: AML/CTF programs

This part explains how to build a compliant program, covering risk assessments, CDD, PEP approvals, audits, reporting, and record-keeping.

Layman's guide to Part 6: Customer Due Diligence

Learn what customer due diligence means, from ID checks and beneficial ownership to ongoing monitoring, enhanced checks, and record-keeping.

Layman's guide to Part 9: Reporting

Understand AUSTRAC's reporting rules: when to file Suspicious Matter Reports (SMRs), Threshold Transaction Reports (TTRs), and annual AML/CTF compliance reports.

Businesses that are affected by the Act must register with AUSTRAC (Australian Transaction Records and Analysis Centre), the government agency responsible for deterring financial crime.

Once your business is registered, you are a "reporting entity" and need to keep up with your obligations under the Act. This means:

- Carrying out risk assessments

- Developing a written AML/CTF program to manage compliance.

- Appointing a compliance officer.

- Collecting and verifying key client details before providing services – often referred to as ‘know your customer’ (KYC) information. This can mean taking verified copies of documents or using a credit-reporting body (CRB) to find and verify details.

- Reporting certain types of transaction – those over a certain monetary threshold, international transfers, information about carrying or shipping physical currency and any suspicious transactions or interactions.

- Keeping and securely storing records showing your AML/CTF activity.

- Submitting compliance reports if requested.

- Paying an industry levy if your business earns over a certain threshold.

Education and guidance by AUSTRAC

Guidance and educational materials are being developed to support both current reporting entities and Tranche 2 entities to implement effective AML/CTF measures.

AUSTRAC will provide further guidance in 2025, including:

- the scope of the new regulated services.

- core obligations and how they can be practically implemented.

- AUSTRAC is also developing AML/CTF starter program kits for small businesses in Tranche 2 sectors. The kits aim to increase the effectiveness of AML/CTF programs and will provide an AML/CTF program for a typical low complexity small businesses. They will reflect sector-wide money laundering, terrorism financing and proliferation financing risk and industry practice.

- AUSTRAC advises that guidance is being developed in close consultation with industry associations and peak bodies and will be released for public consultation in mid-2025.

Reform-related guidance currently available on AUSTRAC's website:

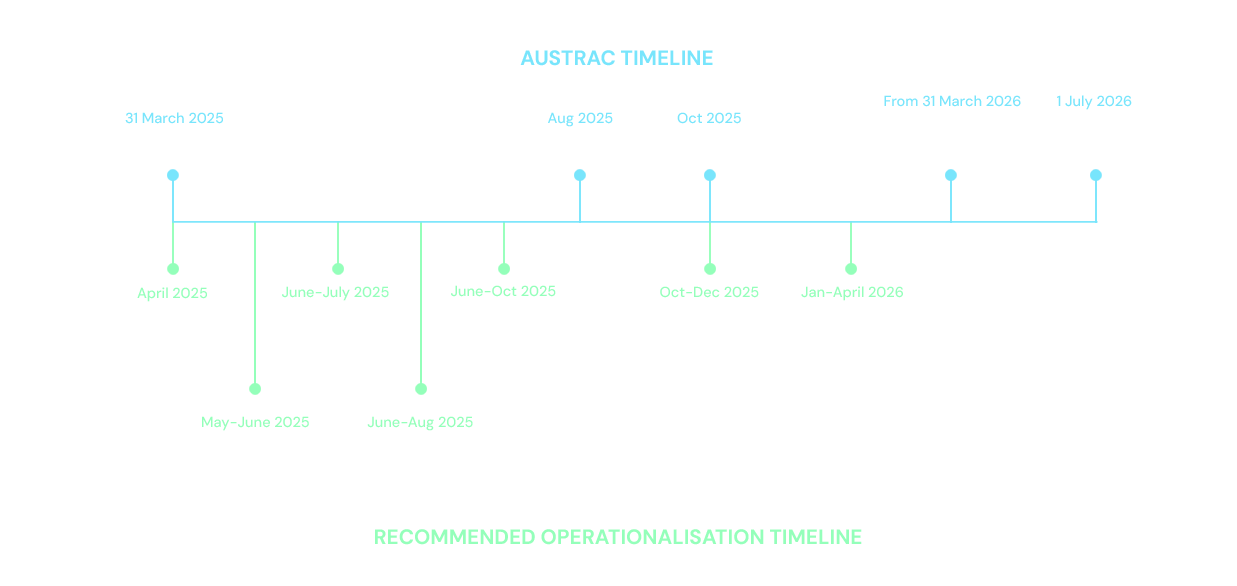

Key dates related to the reforms:

2024/25

- 29 November 2024: Passage of the AML/CTF Amendment Bill

- 10 December 2024: AML/CTF Amendment Act receives Royal Assent

- November 2024 to May 2025: Consultation on AML/CTF Rules

- 11 December 2024 to 14 February 2025 – First exposure draft consultation on AML/CTF Rules

- 7 January 2025: Repeal of Financial Transaction Reports Act 1988

- 31 March 2025: Commencement of changes to the tipping off offence

- May to July 2025: Targeted consultation on draft core guidance in working groups with industry associations and peak bodies

- August 2025: Finalisation of AML/CTF Rules

- October 2025: Finalisation of core guidance

- October to November 2025: Targeted consultation on Tranche 2 sector-specific guidance in industry working groups

- December 2025: Finalisation of Tranche 2 sector-specific guidance

2026

- 31 March 2026: Changes to obligations for current reporting entities and virtual assets service providers

- 1 July 2026: AML/CTF obligations commence for Tranche 2 entities

- 29 July 2026: New reporting entities to enrol by this date.

- 2026: Ongoing enhancements to the sector-specific guidance for current reporting entities in partnership with industry.

- Post 2026: International value transfer service reporting will commence under transitional arrangements (previously referred to as ‘international funds transfer instruction’ reporting).

Tech Buyers Guide

There's a treasure trove of AML tools and technologies designed to automate, streamline and ensure consistent compliance. The bad news is, it can be overwhelming!

This guide describes the different types of AML software, their functions, and how they fit in different AML workflows.

Industry guides to navigating Tranche 2 reforms

Real estate

Learn how First AML can get you compliant without risking transactions or customer relationships.

Law and Conveyancing

Get ahead of the game. Find out how First AML can give you a better picture of your clients, better data, quicker to onboard and get you to chargeable time quicker.

Accounting

Learn how to meet your compliance requirements while protecting your bottom line and making KYC/KYB an easy process for your clients.

AML Glossary of Terms

Anti-money laundering can seem to have its own dialect, get clued in on everything compliance with this glossary of AML terms you need to know.

Tranche 2 resources

Countdown to Compliance

Get ahead of Tranche 2.

|

This free educational series, developed with input from AML experts and compliance officers in New Zealand and the UK, is designed to help law firms, real estate agents, and accounting firms navigate the upcoming Tranche 2 AML/CTF regulations. |

Sign up now |